Shareholder Return (Dividends, Purchase of Treasury Shares)

Financial Results Presentation 1H FY 03/2026(November 11, 2026)

![[Reference] Dividends [COMSYS Group 2030 Vision] Commit to raising dividends by at least ¥5/year](/english/ir/kabushiki/img/return_im02.webp)

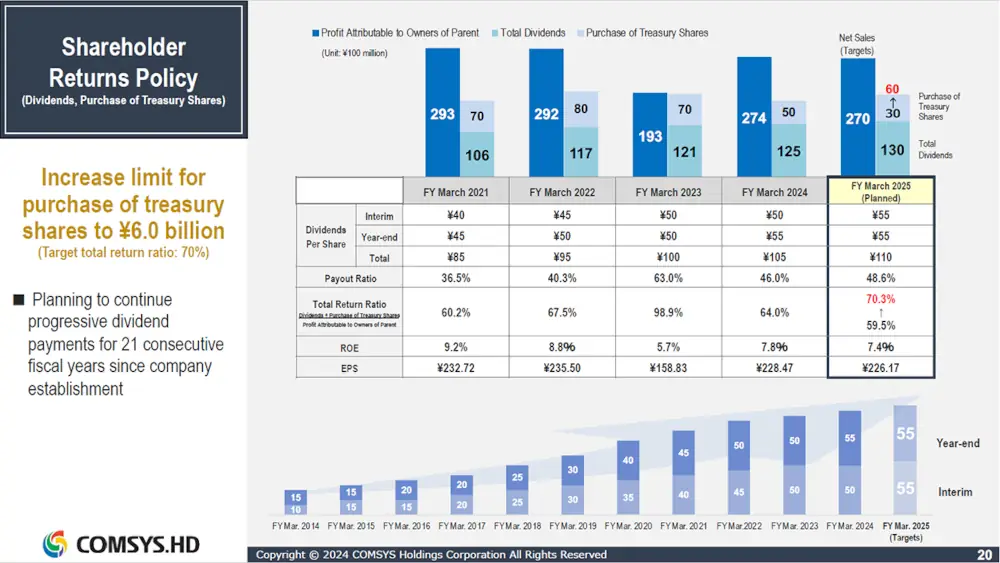

Dividends Per Share and Total Return Ratio

| Dividends Per Share(Yen) | Total Return Ratio(%) | |||

|---|---|---|---|---|

| Interim | Year-end | Total | ||

| FY Mar. 2026(Planned) | 60 | 60 | 120 | 77.1 |

| FY Mar. 2025 | 55 | 60 | 115 | 65.1 |

| FY Mar. 2024 | 50 | 55 | 105 | 64.0 |

| FY Mar. 2023 | 50 | 50 | 100 | 98.9 |

| FY Mar. 2022 | 45 | 50 | 95 | 67.5 |

Share Buybacks

| Acquisition period | Acquisition method | Total number of shares acquired | Total acquisition price (100 million yen)* |

|---|---|---|---|

| May 12, 2025 – March 31, 2026 | Purchase on the Tokyo Stock Exchange | 4,000,000(upper limit) | 100(upper limit) |

| November 11, 2024 – March 31, 2025 | Purchase on the Tokyo Stock Exchange | 930,200 | 30 |

| May 13, 2024 – March 31, 2025 | Purchase on the Tokyo Stock Exchange | 963,900 | 30 |

| May 12, 2023 – March 31, 2024 | Purchase on the Tokyo Stock Exchange | 1,621,800 | 50 |

| November 11, 2022 – March 31, 2023 | Purchase on the Tokyo Stock Exchange | 825,000 | 20 |

| May 13, 2022 – March 31, 2023 | Purchase on the Tokyo Stock Exchange | 1,964,200 | 50 |

| November 11, 2021 – March 31, 2022 | Purchase on the Tokyo Stock Exchange | 1,494,000 | 40 |

| May 17, 2021 – March 31, 2022 | Purchase on the Tokyo Stock Exchange | 1,324,600 | 40 |

*Figures are rounded to the nearest 100 million yen.

Status of treasury stock cancellation

| Cancellation date | Types of shares | Total number of shares to be cancelled (shares) | Percentage of total shares issued (%) |

|---|---|---|---|

| May 31, 2023 | Common stock of the Company | 8,000,000 | 5.67 |

*We plan to cancel 15,000,000 shares on March 31, 2026.

Shareholder Benefits

We do not offer any shareholder benefits.